Speak to our team

Interested in learning more about the Global Flood Model? Fill in the form below to speak to one of our team.

Part one

Making our flood science and data accessible for our clients has always been a core belief at JBA, which is why we’ve partnered with Nasdaq to release JBA’s first of its kind Global Flood Model on the Nasdaq Risk Modelling for Catastrophes solution.

In a recent webinar with Nasdaq, we explored how global coverage and unprecedented user customisation options can help re/insurers to successfully manage flood exposure worldwide and truly own their view of risk, for the first time. Part one of our blog series examines global loss quantification and how the model’s flexibility options can be leveraged via the Nasdaq solution.

Reinventing the flood model

There has long been a need for global flood modelling in the re/insurance industry. Gaps in model coverage and, subsequently, a limited understanding of the risk in those regions has meant insured flood losses remain high in some parts of the world.

However, modelling globally using traditional model-build techniques would have been impossible because of the huge amounts of processing power and data required at that scale. As a result, we had to completely rethink the way catastrophe models are built and developed our new catastrophe risk modelling technology, to enable us to model flood globally.

Modelling ON-THE-FLY

JBA's modelling technology, integrated in Oasis LMF, reinvents catastrophe model development – rather than pre-building and pre-compiling a model using set parameters and data, the user brings the model into being at run time for the exact portfolio provided, directly from the data they choose.

Modelling on-the-fly means we can overcome another key challenge faced by re/insurers: truly owning your view of risk. The Global Flood Model provides users with more flexibility and more customisation options than ever before to capture a view of risk specific to their portfolio, addressing the regulatory requirement for re/insurers to thoroughly understand, justify and own their view of risk.

Analysis and data settings can both be varied, with user choices including:

- Optional flood defences

- Multiple hours clauses

- Multiple flood types

- Optional tropical cyclone activity

- Multiple depth thresholds

- Choice of flood map resolution

- Specification of hazard exposure buffer

- Choice of selecting, editing or uploading vulnerability functions

No more flood model gaps

Through the Global Flood Model, we’re now able to offer a flood model for anywhere in the world. Building on our leading Global Flood Map and Global Flood Event Set, the Global Flood Model is the only one of its kind in the industry and uniquely enables probabilistic quantification of flood losses at any location across the globe. Users can run individual country portfolios or analyse across regional or even global scales to see how exposure compares across their book.

By running some simple portfolios representing GDP and population per country, we can quickly produce some interesting stats. For example, of the top 20 at risk countries, nine are in Africa, eight in Asia and three in South America – three regions which have so far had very limited flood model coverage. Those eight countries in Asia hold more than 60% of the population at risk to inland flood annually in the world and account for almost 50% of global flood losses.

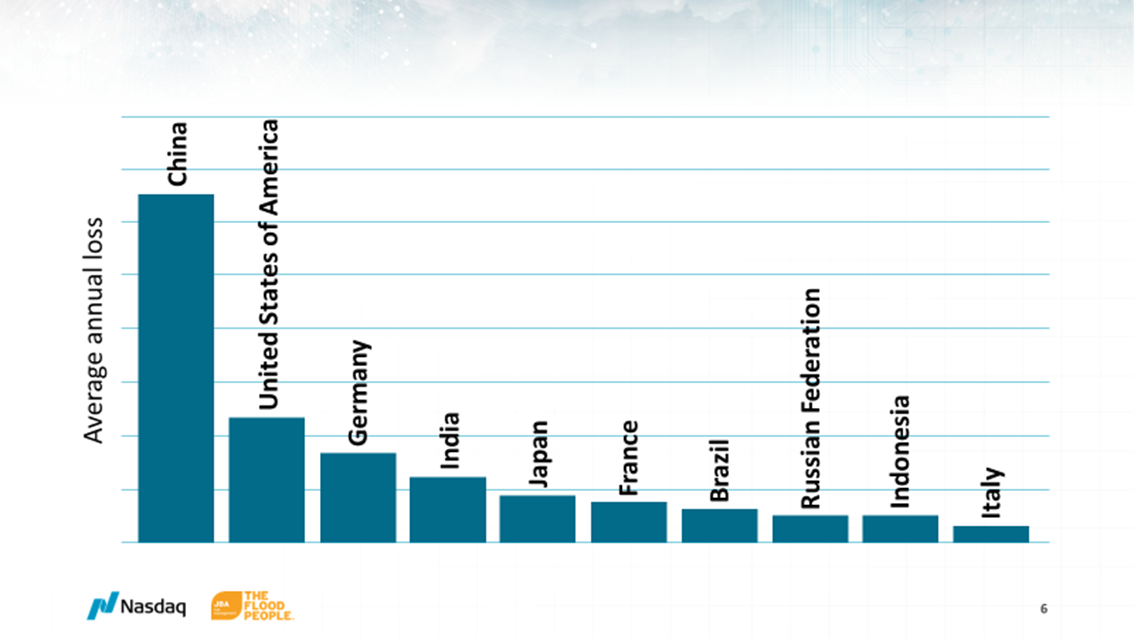

For a quick assessment of potential flood loss, Figure 1 shows China dominating the Average Annual Loss. This is based on a GDP portfolio, so the results heavily reflect the GDP of China, and with a population of almost 1.4 billion and huge rivers such as the Yellow and Yangtze, this isn’t surprising.

Figure 1: AAL for an example global portfolio.

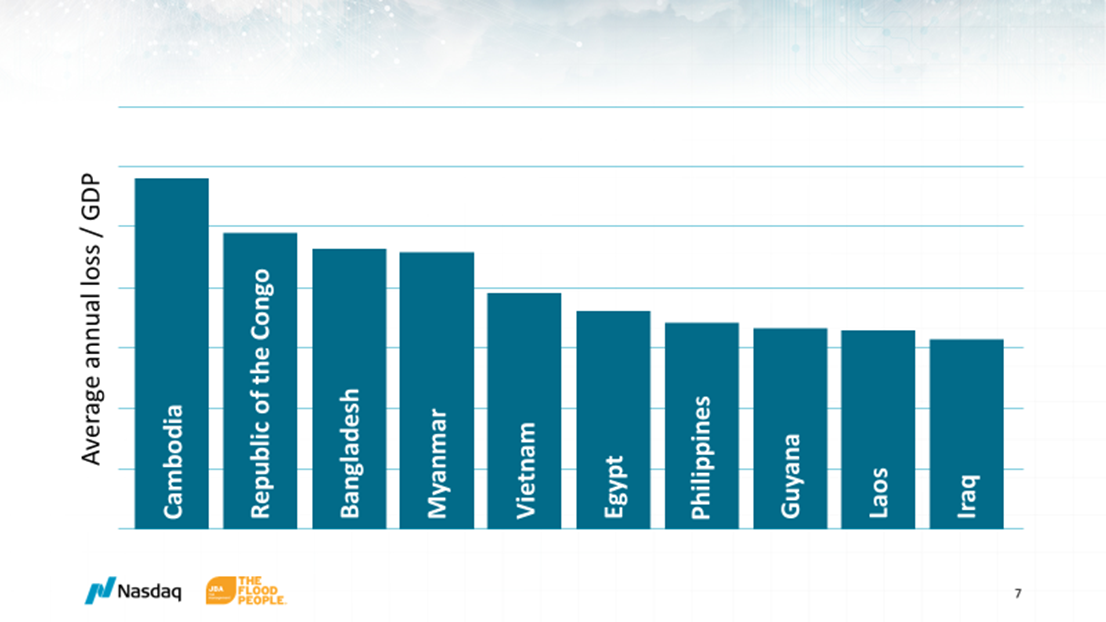

However, when Average Annual Loss is normalised by GDP, we see some interesting, and perhaps surprising, countries at the top, including countries with no previous flood model coverage (Figure 2).

Vietnam ranks fifth for AAL as a proportion of GDP. Vietnam has experienced significant investment in recent years with rapid growth of industrial parks. According to JBA estimates over 60% of industrial parks fall within the 50-year flood extent, leading to concerns that an event in Vietnam could repeat the huge losses experienced in Thailand in 2011, despite a limited range of flood models available for the country.

Figure 2: AAL normalised by GDP for an example global portfolio

This is just the start. The Global Flood Model enables re/insurers to effectively understand their risk to flood at any location worldwide, with the ability to investigate their exposure in more depth than ever before.

Leveraging the model

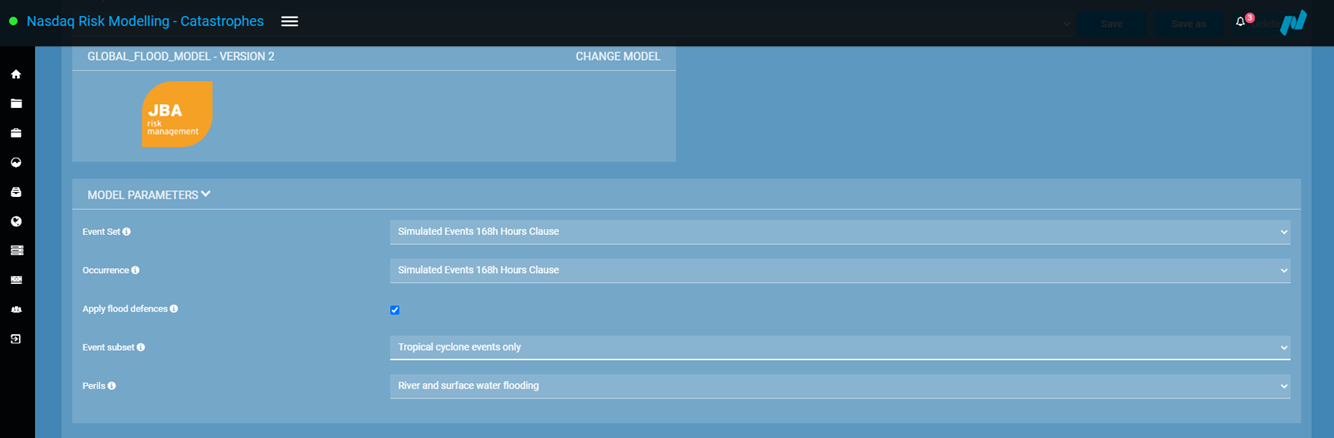

The extensive user customisation options discussed earlier can be easily leveraged via Nasdaq Risk Modelling for Catastrophes.

Nasdaq Risk Modelling is an easy-to-use and accessible platform that enables re/insurers to make full use of the Global Flood Model, regardless of technical experience, through a range of simple drop downs and upload functions (Figure 3). Nasdaq Risk Modelling is a software as a service solution which mean that users can access the Global Flood Model without any on-site installation.

Figure 3: Screenshot of the NRMC interface demonstrating various customisation options.

This together with the intuitive user-interface makes leveraging our leading flood data easier than ever before.

A step forward for the industry

JBA’s Global Flood Model changes the way we approach flood modelling.

The Global Flood Model’s wide range of customisation capabilities is unique. Previously in my career, I was Global Head of Catastrophe Risk Management for a large multinational insurer and it would have been absolutely amazing at that time to have this tool available. Flood happens pretty much anywhere in the world and so many re/insurers are also managing exposures anywhere in the world. A tool which gives you a consistent, probabilistic global view of flood would have been very helpful. I think this will be an essential tool to have for the vast majority of exposure, cat and risk managers.

In part two of our blog series, we will explore the impact this customisation has on losses and how re/insurers can really dig into their analysis to fully understand the results.

Book a demo and access the Global Flood Model via Nasdaq here.